income tax calculator uk

Based on a 40 hours work-week your hourly rate will be 1923 with your 40000 salary. Income Tax is a tax you pay on your earnings - find out about what it is how you pay and how to check youre paying the right amount using HMRCs tax calculator.

After Tax Calculator Online 52 Off Www Smokymountains Org

Check your tax code - you may be owed 1000s.

. By using the calculator above you are able to calculate your income tax national insurance income from dividends student loan repayments and your total net income all based upon your income. The calculator estimates your net pay based on your employment income. Marriage tax allowance 3.

The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Collected through PAYE by the employer. You can also see the rates and bands without the Personal Allowance.

Calculate your take-home pay including how much you will pay in national insurance and income tax with our FREE tool. This is the take home pay received after any deductions or taxes have been subtracted from Gross income. Student loan pension contributions bonuses company car dividends Scottish tax and many more advanced features available in our tax calculator below.

This salary calculator has the capability to display your pay details as they would have been back as far as 1999. You can see the exact breakdown above when you. If you are looking for a feature which isnt available contact us and we will add your requirements to.

Tax Calculator for 202122 Tax Year. Free tax code calculator 2. Transfer unused allowance to your spouse.

The 202122 tax calculator provides a full payroll salary and tax calculations for the 202122 tax year including employers NIC payments P60 analysis Salary Sacrifice Pension calculations and more. Hi community Im in the process of filing my rental income tax return for tax year 2021-2022. The latest budget information from April 2022 is used to show you exactly what you need to know.

10000 20000 30000 40000 50000 60000 70000. As a result working out your income tax and other costs can become quite tricky. Calculate your tax National Insurance and take-home pay.

Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income. The UK has a complex tax system. Tax Calculator 2022-2023.

Click to go back to top. If you earn 40000 a year then after your taxes and national insurance you will take home 30879 a year or 2573 per month as a net salary. This UK Tax Calculator will make light work of calculating the amount of take home pay you should have after all income tax deductions have been considered.

How many income tax brackets are there in the UK. It asks for your income along with any taxable benefits or deductions you may have as well as any pension contributions you may make. 20000 after tax breaks down into 1415 monthly 33000 weekly 6600 daily 963 hourly net salary if youre working hours per week.

Rental income tax - allowable expense calculation. Hourly rates weekly pay and bonuses are also catered for. Its important to remember when calculating your taxes that the rates only apply to a portion of your income and not the whole amount.

Up to 2000yr free per child to help with childcare costs. The individual income tax rate in the UK is progressive and ranges from 19 to 46 depending on your income. Salary Take Home Pay.

This income tax calculator can help estimate your average income tax rate and your take home pay. The latest budget information from April 2022 is used to show you exactly what you need to know. Why not find your dream salary too.

Why not find your dream salary too. 13 rows Note that for UK income above 100000 the Personal Allowance reduces by 1 for every 2 of. Uniform tax rebate 4.

PAYE Pay As You Earn - A process by which HMRC collects employee taxes directly from the employer. Married couples over the age of 65 may have an increased tfa and do not pay national insurance. Tax calculation summary for 40000 Yearly salary.

It then calculates how much tax and NICs to. Reduce tax if you wearwore a uniform. It breaks down like this.

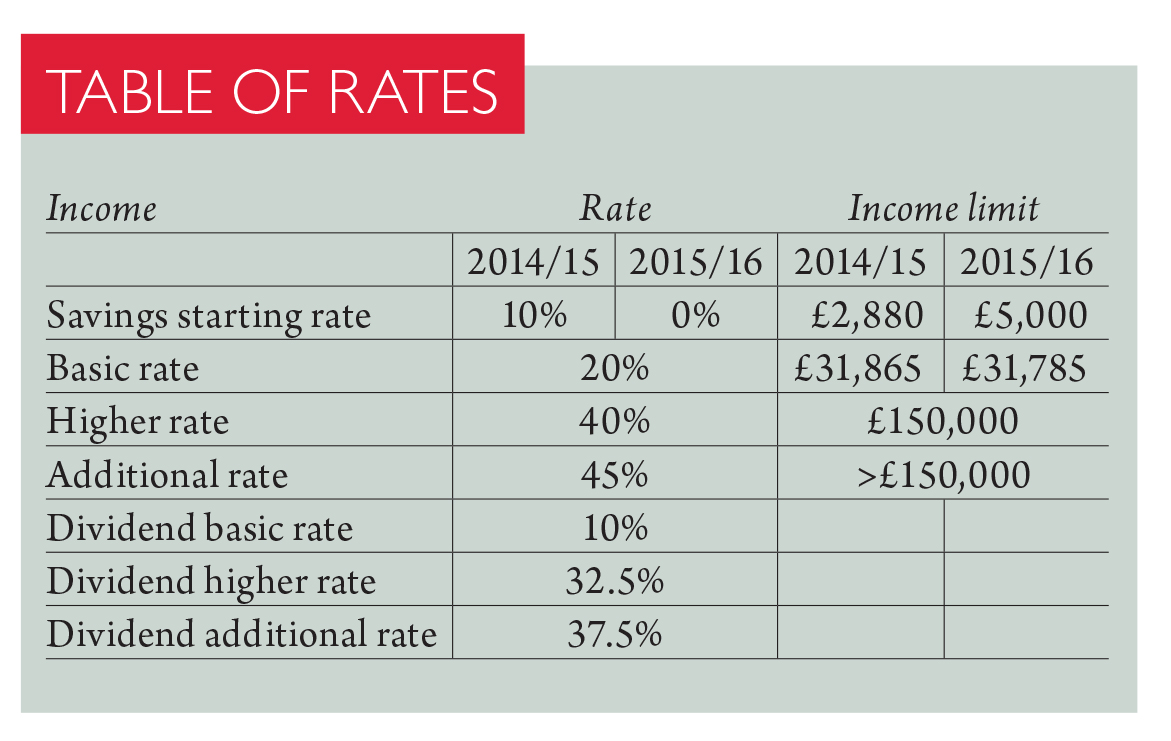

Remember that the tax year begins on April 6th of each year. The income tax system in the UK has 3 different tax brackets for those in England and. It calculates how much income is subject to tax and NICs and at what rates.

The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. An accurate breakdown of your pay is provided by incorporating the calculations for the following common pay allowances and deductions. The Personal Allowance for the tax year 202223 is 12570 meaning most people can receive up to this amount without paying Income Tax on it.

For example if you earn 6000 a year youre not taxed 40 of this full amount. Hourly rates weekly pay and bonuses are also catered for. In most of the UK any income you receive above this amount will be charged at the 20 per cent basic rate 40 per cent higher rate or 45 per cent additional rate depending on how much it is.

My rental property is a leasehold property which requires twice-a-year service charge payments one which covers 2021 H1 from January to June and another one for 2021 H2 from July to December. Net pay - Also known as net salary or net income. Info On The Inputs.

Income After Tax Breakdown UK 20000 after tax is 16981 annually based on 2022 tax year calculation.

How To Calculate Income Tax In Excel

Income Tax Co Uk Income Tax Co Uk Uk Tax Calculator

Income Tax Co Uk Uk Tax Calculator Home Facebook

Sujit Talukder On Twitter Online Taxes Budgeting Income Tax

Download Uk Vat Payable Calculator Excel Template Exceldatapro Excel Templates Templates Invoice Template

Download Adjusted Gross Income Calculator Excel Template Exceldatapro Adjusted Gross Income Income Federal Income Tax

Income Tax Calculator Uk Online 60 Off Cocula Gob Mx

Wage Calculator Uk Shop 55 Off Www Ingeniovirtual Com

Download Adoption Tax Credit Calculator Excel Template Exceldatapro Tax Credits Excel Templates Federal Income Tax

Net Income Tax Calculator Manitoba Canada 2020

Uk Tax Calculator Deals 52 Off Www Ipecal Edu Mx

Self Employed Taxes How To Calculate Your Tax Payments Business Money Tax Money Advice

Income Tax Calculator Uk Shop 53 Off Www Ipecal Edu Mx

Check How Much Hmrc Income Tax You Paid Income Tax Return Income Tax Tax Return

Use The Interactive Online Emi Calculator To Calculate Your Home Loan Emi Get All Details On Inter Life Insurance Premium Life Insurance Calculator Income Tax